Voting and Ballot Information

See below for a breakdown of the bond proposal ballot language as well as key information about the vote!

Voting Information

Registering to vote

The last day for voters to register by mail is April 21, 2025

Voters may register in person through May 6, 2025 (election day) with the required documentation

Absentee Voting

Absentee voter ballots are available to the general public from March 27 until May 6, 2025 (election day)

On or before Saturday, March 22, 2025 - Absentee voter ballots must be available to be sent to voters serving in the military or living overseas

Absentee voter ballots must be available by Thursday, March 27, 2025 to be sent to members of the general public

Contact your local clerk with questions

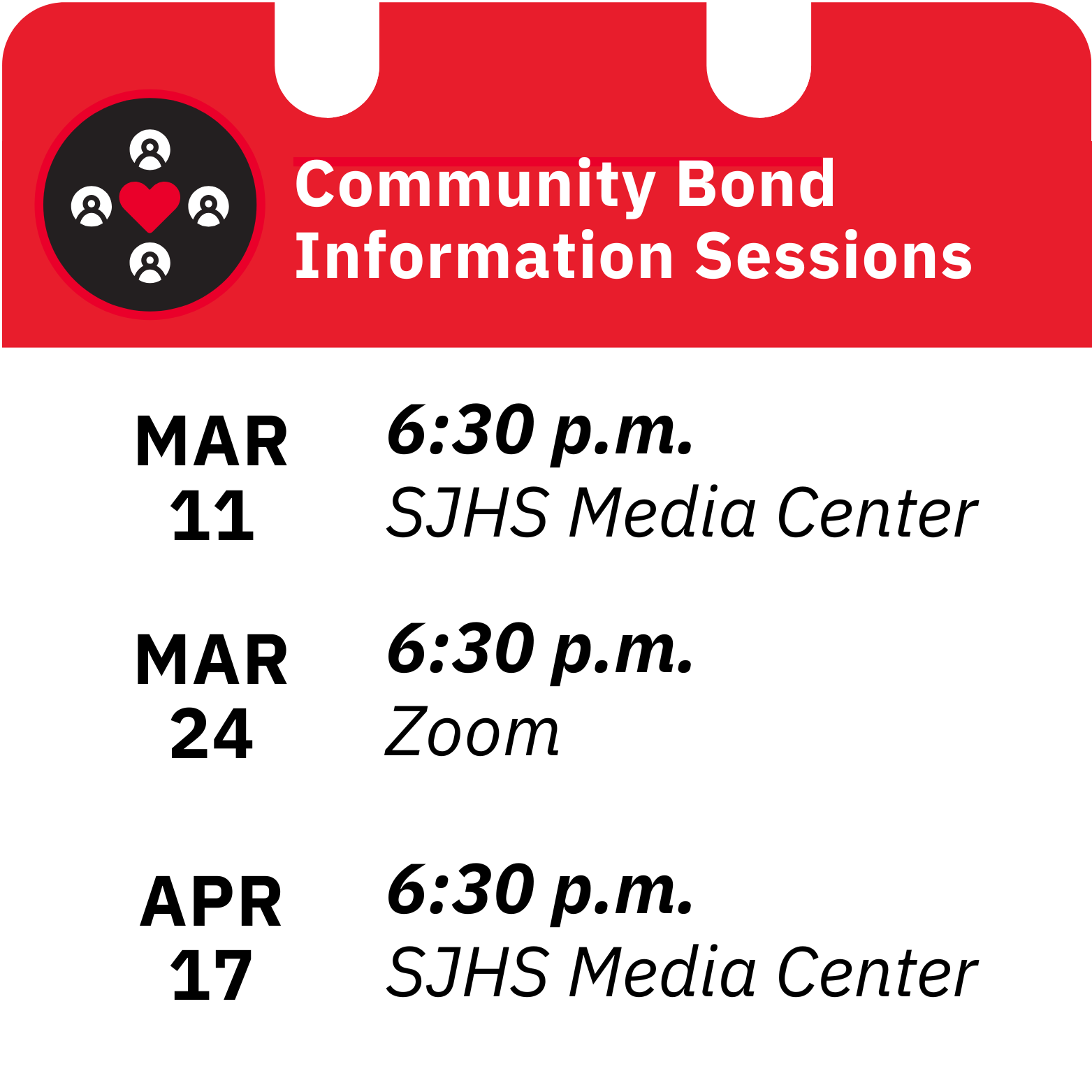

Attend a public information community forum:

March 11 at 6:30 p.m. at the High School Media Center

March 24 at 6:30 p.m. via Zoom

April 16 at 6:30 p.m. at the High School Media Center

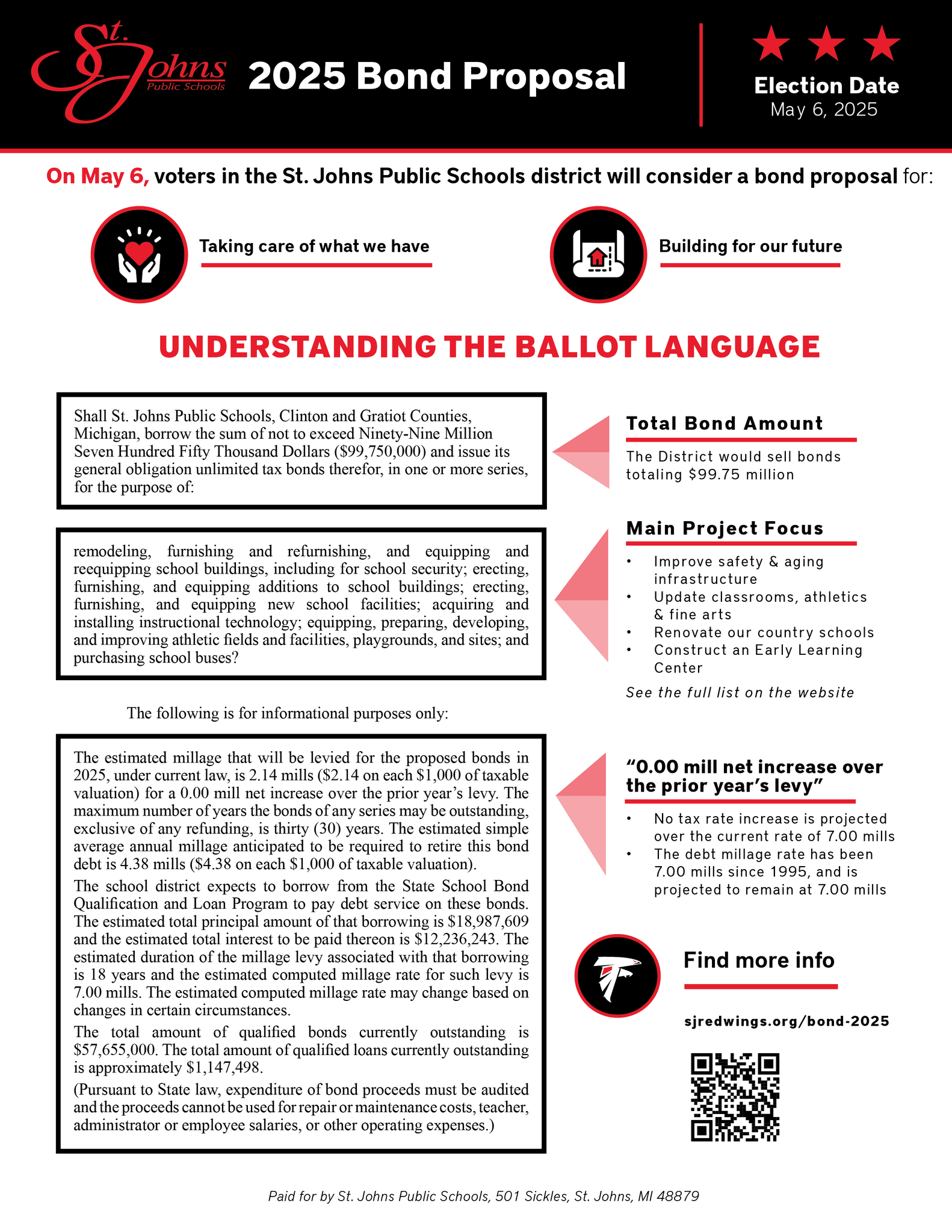

Ballot Language Breakdown

What is the ballot language?

The language that will appear on the May 6 ballot is as follows:

Shall St. Johns Public Schools, Clinton and Gratiot Counties, Michigan, borrow the sum of not to exceed Ninety-Nine Million Seven Hundred Fifty Thousand Dollars ($99,750,000) and issue its general obligation unlimited tax bonds therefor, in one or more series, for the purpose of:

remodeling, furnishing, and refurnishing, and equipping and re-equipping school buildings, including for school security; erecting, furnishing, and equipping additions to school buildings; erecting, furnishing, and equipping new school facilities; acquiring and installing instructional technology; equipping, preparing, developing, and improving athletic fields and facilities, playgrounds, parking areas, and sites; and purchasing school buses?

The following is for informational purposes only:

The estimated millage that will be levied for the proposed bonds in 2025, under current law, is 2.14 mills ($2.14 on each $1,000 of taxable valuation) for a 0.00 mill net increase over the prior year’s levy. The maximum number of years the bonds of any series may be outstanding, exclusive of any refunding, is thirty (30) years. The estimated simple average annual millage anticipated to be required to retire this bond debt is 4.38 mills ($4.38 on each $1,000 of taxable valuation).

The school district expects to borrow from the State School Bond Qualification and Loan Program to pay debt service on these bonds. The estimated total principal amount of that borrowing is $18,987,609 and the estimated total interest to be paid thereon is $12,236,243. The estimated duration of the millage levy associated with that borrowing is 22 years and the estimated computed millage rate for such levy is 7.00 mills. The estimated computed millage rate may change based on changes in certain circumstances.

The total amount of qualified bonds currently outstanding is $57,655,000. The total amount of qualified loans currently outstanding is approximately $1,147,498.

(Pursuant to State law, expenditure of bond proceeds must be audited and the proceeds cannot be used for repair or maintenance costs, teacher, administrator or employee salaries, or other operating expenses.)

In the ballot language, the first paragraph states a not to exceed figure of $99,750,000 of general obligation unlimited tax bonds, what does this mean?

If this bond proposal is approved by voters, the maximum amount of bonds to be issued can be no greater than

$99,750,000.

In the ballot language, it states that the estimated millage that will be levied in 2025 to pay the proposed bonds in the first year is 2.14 mills, what does this mean?

This means that the allocated bond millage for this proposal to be levied in the first year (2025) is 2.14 mills.

(2.14 mills new bonds + 4.86 mills existing bonds = 7.00 total estimated 2025 millage rate)

In the ballot language, it states that the maximum number of years any series of bonds may be outstanding, exclusive of refunding, is not more than 30 years, what does this mean?

The school district plans to issue the bonds in 3 separate series, in 2025, 2027 and 2029. Each bond series would have a length of 30 years or shorter.

In the ballot language it states that the estimated simple average annual millage that will be required to retire each bond series is 4.38 mills annually, what does this mean?

This means that over the entire life of the bond proposal (3 bond series) that the average annual bond millage rate is estimated to be 4.38 mills.

In the ballot language it states that the school district does expect to borrow from the State to pay debt service on the bonds. It also says the estimated total principal amount of the borrowing is $18,987,609 and estimated interest is $12,236,243. What does this mean?

In order to achieve a lower targeted total bond millage rate of 7.00, the school district is utilizing a State program known as the School Loan Revolving Fund ("SLRF"). The SLRF provides loans to school districts for voted bond issues reducing the amount property taxes needed to be collected from the community in order to fund the annual bond payments during the borrowing period. This paragraph provides the estimated amount of borrowing and interest associated with this bond proposal by participating in the SLRF.

In the ballot language it states that the estimated duration of the borrowing is 18 years and that the estimated computed millage rate for such levy is 7.00 mills. What does this mean?

This section means that it is estimated that the school district will participate in the School Loan Revolving Fund

("SLRF") for a 18-year duration and that the presently agreed upon participation bond millage rate is 7.00.

In the ballot language it states that the amount of qualified bonds currently outstanding is $57,655,000 and that the total amount of qualified loans currently outstanding is $1,147,498. What does this mean?

The Michigan School Bond Qualification and Loan Program ("SBQLP") is a state program that assists school districts with voted bond issues by providing a bond rating credit enhancement which assists in reducing borrowing costs. The term "qualified" in this case means that the school district has existing bonds outstanding that are qualified by the SBQLP. At the time of the election the principal amount of qualified bonds is $57,655,000. Another State program known as the School Loan Revolving Fund ("SLRF") provides loans to school districts to assist with voted bonds annual payments if needed. The term "qualified loans" refers to any SLRF loan balances outstanding. The school district has needed to borrow from this program and therefore the balance at the time of the election is $1,147,498.