Bond Frequently Asked Questions

The St. Johns Public Schools community will have the opportunity to vote on a bond proposal on the May 7, 2024 election ballot. If approved by voters, this bond proposal would provide $92 million for district-wide improvements with a projected zero mill increase, meaning there is no tax rate increase expected from the current rate.

The St. Johns Public Schools community will have the opportunity to vote on a bond proposal on the May 7, 2024 election ballot. If approved by voters, this bond proposal would provide $92 million for district-wide improvements with a projected zero mill increase, meaning there is no tax rate increase expected from the current rate.

Below is a list of Frequently Asked Questions about the scope and financial information of the bond.

Bond Scope Questions

What is a bond proposal and how can funds from a bond be spent?

A bond proposal is how a public school district asks its community for authorization to borrow money to pay for capital expenditures. Voter-approved bond funds can be spent on new construction, additions, remodeling, site improvements, athletic facilities, playgrounds, buses, furnishings, equipment, and other capital needs. Funds raised through the sale of bonds cannot be used on operational expenses such as employee salaries and benefits, school supplies, and textbooks. Bond funds must be kept separate from operating funds and expenditures must be audited by an independent auditing firm.

What are the main focus areas of this bond?

This bond proposal addresses high-priority projects and focuses on improving four key areas: Safety & Security, Early Childhood Care, Infrastructure & Education Efficiencies, and Athletic & Arts Facilities.

Why a bond proposal now?

In 2010, voters approved a $64 million bond issue for improvements to the high school, technology and buses throughout the district, and athletics sites. While the 2010 bond took care of some critical issues at that time, there are many infrastructure systems that have since outlived their expected useful lives. This bond proposal would address the remaining, currently identified issues. The District continues to perform preventative maintenance on these systems. Specific systems have exceeded their expected lifecycle(s) – roofing, flooring, etc. If the bond proposal is approved, it would include the replacement of the identified systems and would extend the useful life of our school buildings. This bond proposal also addresses educational programs and learning environments by constructing a new early childhood center and improving athletics and fine arts facilities.

How would a new Early Childhood Center be helpful for district operations?

The bond would fund construction of a new Early Childhood Center where Oakview Elementary is located. SJPS currently offers early childhood programs at our elementary schools, which is causing crowding.

- Removing early childhood programming from our elementary schools will free up space in those schools and allow the district to expand access to additional early childhood programming.

- Consolidating the programs in one building would improve issues with staffing and licensing and allow the focus to be on early childhood education. These programs may include additional sections of GSRP, tuition-based preschool programming, childcare, before and after-school childcare and early childhood special education.

- The building would have a gym available for community rental along with a community conference room.

How would our community benefit from an Early Childhood Center?

We have included an ECC in the bond proposal for the following reasons:

- Improved educational outcomes: Research shows that high-quality early childhood education programs have a profound impact on student outcomes.1

- Meeting demand: There is unmet demand for care of children ages 0-5; much of St. Johns falls in a "Daycare Desert."2

- Efficiency of resources: We could consolidate our existing early childhood programs into a single facility, helping with licensing and shared staff resources.

- Freeing up elementary space: Moving programs out of our elementaries allows us to relieve crowded classrooms and use our spaces more effectively.

See below for research.

1Childcare demand:

Clinton and Gratiot counties are considered counties with low capacity for childcare, meaning there is greater demand for childcare than there are spots available. For general reference, only one county in the state had enough spots for children in 2020. For this analysis, a county is considered to be a childcare desert if the ratio of kids ages 0-5 to licensed spots is greater than 3, have low capacity if the ratio is between 1.5 and 3, and have moderate capacity if the ratio is below 1.5.

Here is the most recent data from Clinton County: https://mlpp.org/ThinkBabiesChildCare/Clinton.pdf outlines that for every 1 licensed childcare spot available, there are 2.2 children on the waitlist to fill the spot, indicating there are more unfilled needs for childcare than actually available.

Here is the most recent data from Gratiot County: https://mlpp.org/ThinkBabiesChildCare/Gratiot.pdf outlines that for every 1 licensed childcare spot available, there are 2.7 children on the waitlist to fill the spot, indicating there are more unfilled needs for childcare than actually available.

2Research on the benefits of early childhood education:

Here are several key findings and studies highlighting the significant impact of high-quality early childhood education programs on future outcomes for students:

Long-Term Academic Achievement:

Abecedarian Project (1972-Present): A landmark study that began in the 1970s, demonstrating the lasting impact of high-quality early childhood education. Participants received early educational intervention from infancy through preschool. Results showed better cognitive abilities, academic achievement, and increased rates of college attendance and employment.

(The findings from this project have been published in various academic journals. Searching for "Abecedarian Project research" in databases like PubMed, JSTOR, or Google Scholar will likely yield peer-reviewed articles and publications related to this study.)

Perry Preschool Project (1962-Present): Another influential study that followed children who attended a high-quality preschool program. The findings showed that participants had higher high school graduation rates, better employment prospects, and decreased involvement with the criminal justice system compared to their peers who didn’t attend such programs.

(Similar to the Abecedarian Project, information and publications about the Perry Preschool Project are available in academic databases. Searching for the project name in the aforementioned databases will provide access to related research papers and articles.)

Social and Emotional Development:

Chicago Child-Parent Centers (CPC) Program: A longitudinal study following low-income children enrolled in CPCs showed improved social-emotional skills, decreased behavior problems, and greater school readiness. Participants had better educational outcomes and were more likely to avoid crime.

(Studies on the CPC program have been published in journals focusing on education, child development, and social sciences. Searching for "Chicago Child-Parent Centers Program research" in academic databases will lead you to relevant studies.)

Economic Benefits:

Economic Policy Institute (EPI) Report: Reports from the EPI suggest that investments in high-quality early childhood education yield significant economic returns. These benefits include reduced societal costs related to remedial education, healthcare, and criminal justice, and increased earnings and tax revenues due to a better-educated workforce.

(The EPI website (epi.org) contains reports, policy briefs, and research papers on various topics, including early childhood education. Browsing their publications or research section should provide access to reports discussing the economic benefits of investing in early childhood education.)

Brain Development:

Harvard Center on the Developing Child: Research on brain development emphasizes the critical period of early childhood when the brain is highly adaptable. Quality early education programs that stimulate cognitive, social, and emotional development can positively impact brain architecture, affecting learning and behavior throughout life.

(The Harvard Center on the Developing Child website (developingchild.harvard.edu) provides a wealth of information, publications, and resources related to early childhood development. Exploring their publications or resources section may lead you to the specific research and studies you're interested in.)

Policy and Implementation:

Ongoing Studies and Meta-Analyses: Continuous studies, including meta-analyses, consistently show the positive impact of high-quality early childhood programs. These analyses aggregate data from various studies to provide a more comprehensive understanding of the long-term effects.

The evidence from these studies and ongoing research strongly supports the notion that high-quality early childhood education programs have profound and lasting effects on children's cognitive abilities, academic achievement, social skills, and overall future outcomes. These findings underscore the importance of investing in and providing access to quality early childhood education for all children.

What ages would the new Early Childhood Center support?

The proposed Early Childhood Center, located on Oakview’s campus, would support ages 0-5, creating centralized access to early childhood care for parents of young children while preparing their students for kindergarten. The ECC is included in this proposal to support not only preschoolers but young families.

The Young Fives Program will remain in the Elementary Schools.

How would new early childhood care offerings be funded?

The Early Childhood Center’s programs for ages 0-5 would be tuition or federal and state grant-based.

Why the addition of a multi-use turf field? Are there safety concerns about synthetic vs. natural turf?

If approved, the existing stadium field would remain natural grass. The current soccer field would be replaced with a new, lighted multi-use synthetic turf field. This multi-use field would increase the hours of playability, reduce required resources and costs for maintenance, and provide a high-quality, highly playable field for our community to use.

This article compares the costs and safety issues related to synthetic and natural turf fields. We will continue to work with our architect/engineer to select a field that will meet the needs of our student and community athletes.

What improvements are included in the proposed auditorium projects?

The bond, if approved, would fund a complete replacement of the stage in the auditorium to support our fine arts programs. New auditorium doors and theatrical lighting improvements would also be included in the proposal.

Why replace playground equipment?

Playgrounds require inspection to ensure that equipment and safety surfacing meet current codes and regulations, including determining if any physical deformations of the equipment exist. To ensure compliance with current codes, as well as considering ongoing maintenance costs to keep the existing equipment safe, it was determined that the replacement of the equipment would be the appropriate long-term solution. This bond would provide funding to improve our youngest learners’ access to play to supplement their classroom learning. Adding new playground equipment at schools would also help to provide an equitable playground experience, no matter which school students attend.

Photos from current playgrounds

Why replace the transportation building?

Our existing maintenance and office structures are beyond their useful life expectancy. Constructing a replacement facility would not only update the building; it would also allow us to incorporate the transportation office into a new facility to eliminate an extra building and improve communication and staff efficiency.

Why not use the East Olive Building?

The East Olive building has aged and is no longer up to code or conveniently located. It would need fire suppression and significant remodeling of most of the building that already does not meet standards for early childhood centers.

Financial and Tax Questions

How would the bond proposal impact my property taxes?

If approved by voters, this bond proposal would provide $92 million for district-wide improvements with zero mill increase expected over the prior year’s levy.

What does it mean that there is "no tax rate increase expected"?

We use the wording expected only to communicate that the tax rate information is a projection of the future. These projections are based on careful analysis of financial data by both the district and our municipal financial advisors based on current information. SJPS does not anticipate an increase in the tax rate.

Below are some financial details of the projection:

- St. Johns Public Schools currently levies 7.0 mills for debt as previous bond debt is paid off.

- If approved by voters the proposal would add a projected 1.95 mills to 5.05 mills expected to be needed in 2024, totaling an estimated 7.0 mills.

- If approved, the rate is projected to remain at 7.0 mills through 2044 with decreases over time as bond debt is paid off.

- Careful financial projections of the projected taxable value of property in our community are calculated with current data.

Is the bond millage rate expected to be the same for the next 30 years?

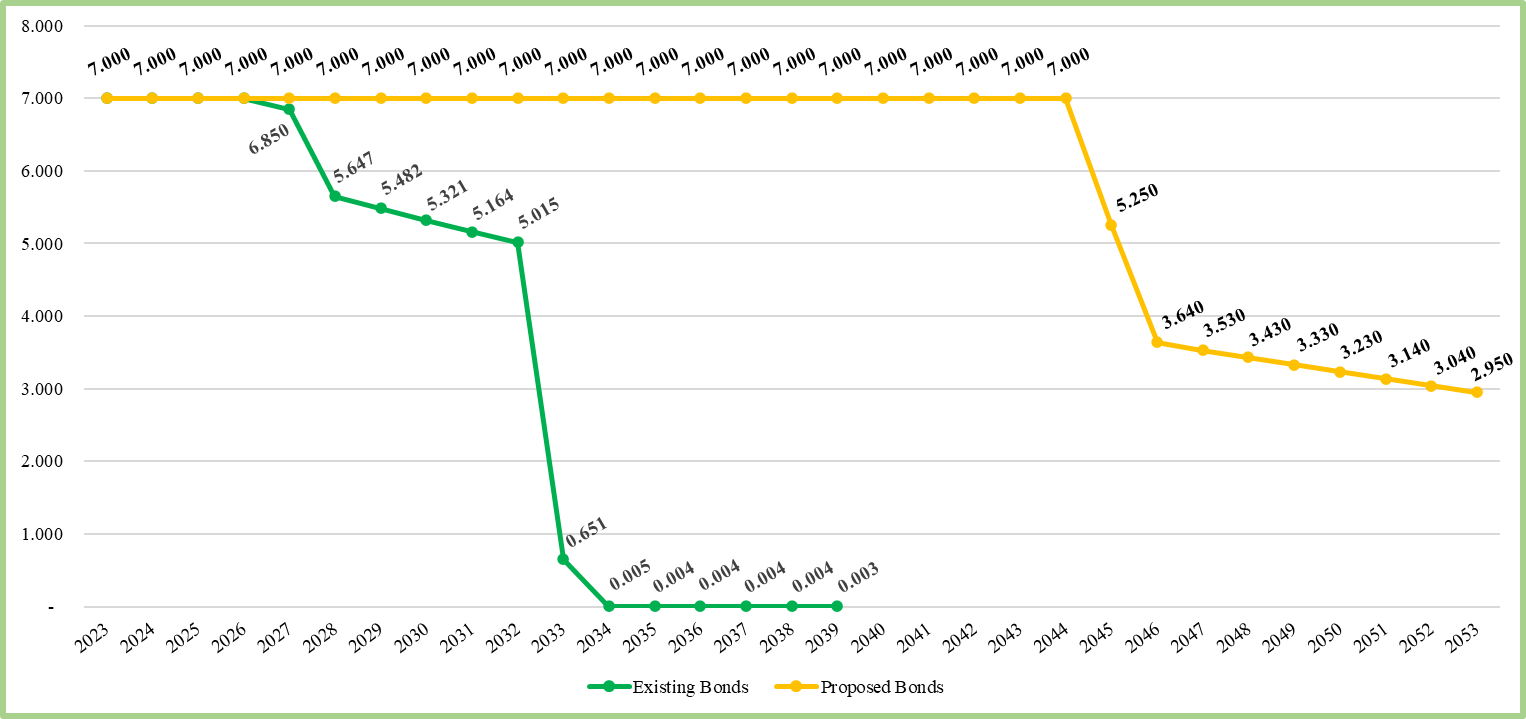

No. The bond millage rate is estimated to remain at 7.0 mills through 2044, and thereafter it is estimated to decline due to bond repayment and taxable value growth, as illustrated in the chart below. If the bond is not approved by voters, the millage rate is estimated to decline to 6.85 mills in 2027.

How can the school district complete this bond proposal without increasing the bond millage rate of 7.00?

Each year the bond millage rate is recalculated based on the school district's new taxable value figure and the bond payment required in the upcoming year. Due to repaying prior outstanding bonds along with taxable value growth, it is estimated that the bond millage rate required to pay the existing bond payments will decline to allow this proposal to be funded without having to change the present bond millage rate of 7.00.

How long has SJPS been levying 7.00 mills?

SJPS’s millage rate has been 7.00 mills without a tax rate increase since 1995.

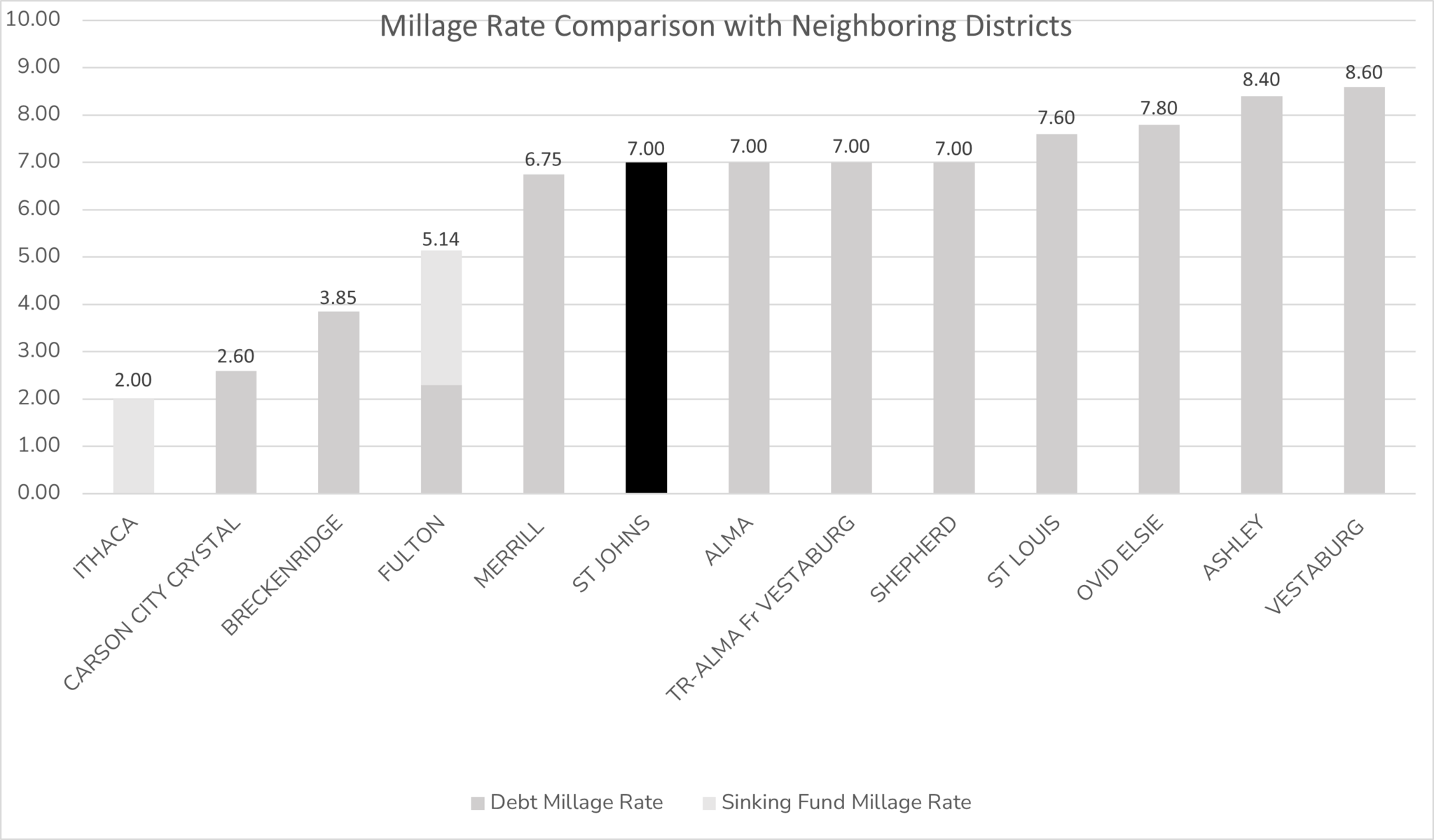

How does the projected millage rate compare to nearby districts?

The graph below shows how the zero-mill increase compares to our neighboring districts.

Why spend money on upgrading old buildings rather than tearing those down and building new ones?

SJPS has very intentionally chosen to continue to enhance Eureka and Riley to ensure these students have access to a similar caliber of learning environments as those at Oakview and Gateway. Using funds to upgrade these buildings—rather than replace them completely—allows bond funds to spread further and be used in other priorities across the district.

How are public schools financed in Michigan? (General fund, bonds, and sinking funds)

Michigan schools are funded through operating millages, bond proposals, and sinking funds. The nature of each of these mechanisms and the cases in which they would be most practical vs. impractical are outlined below:

Operational funding

-

Funding for the day-to-day operations of the district is provided through state, federal and local sources.

- The majority of the funding is allocated through the state per pupil foundation allowance.

- Programs and services, personnel costs, utilities, supplies and maintenance costs are financed in this category.

- Operational funds do not provide enough money to make significant improvements to infrastructure.

Bonds

- A bond proposal is how a public school district asks its community for authorization to borrow money to pay for capital expenditures.

- With a bond, taxpayers approve an amount of bonds to be issued and taxes are collected in the amount necessary to cover principal and interest on bond debt.

- Funds raised through the sale of bonds cannot be used on operational expenses such as employee salaries and benefits, school supplies, and textbooks.

- Bond funds must be kept separate from operating funds.

- SJPS currently levies a combined 7.0 mill debt millage rate.

Sinking funds

- A sinking fund is a proposal that requests voters to approve a taxation on property that would pay for capital expenditures over time.

- Sinking funds have limited allowable uses, including school building construction and repair, school real estate, security improvements, student transportation vehicles, and technology purchases or upgrades.

- A sinking fund may be authorized for a maximum of 3 mills and for no more than 10 years.

- Using sinking funds for large-scale capital improvement projects is not practical.

- A 1-mill tax rate increase would provide approximately $905,000 in the first year. The maximum 3-mill tax rate increase would provide approximately $2.7 million in the first year.

- Larger projects would need to be delayed for several years to develop a large enough fund to complete them.

- SJPS does not have a sinking fund millage.

- If SJPS considered a sinking fund for voters, it would be a tax rate increase, and would need to be approved each time an approved sinking fund expires.

What types of projects do bonds fund? What does the general operating budget fund?

Bonds allow SJPS to prioritize facility advancements without taking from other integral school resources. See below for a breakdown of which types of projects each can fund.

| General Operating Budget | Bond Funds |

|---|---|

|

|

|

How does bond financing work?

School districts operate under a different financial model than personal finances or small businesses, as we do not generate revenue through the sale of goods or services. Instead, our funding primarily comes from the state, based on student enrollment, in the form of our Operating Fund. Bond proposals are designed to finance capital projects, such as new buildings and expansions.

If the bond proposal is approved by the voters, the projects that would be paid for by the bonds would serve the community and be used for many decades. Financing those projects with bonds allows the cost to be spread over multiple "generations" of taxpayers since multiple generations of students and the community would use the projects. Otherwise, the district's current taxpayers would be required to bear the financial burden all at once for projects that would be used for many decades.

Think of selling bonds like purchasing a home. As with a mortgage, interest on the bond will be incurred. For a home that costs $100,000, you make monthly payments on that amount, plus interest, over a specified number of years. The total amount that you pay once your home is paid off is higher than the initial purchase price – but you still consider the cost of your home to be $100,000. And, most homeowners consider the expense worthwhile for the immediate and long-term, generational impact on their household.

The same is true with bonds, although these interest rates cannot be determined until the bonds are sold. In this proposal, the district would sell $92 million in bonds to fund improvements over 6 years. The school district plans to issue the bonds in three separate series as the work is completed: in 2024, 2026, and 2028. Each bond series would have a length of 30 years or shorter. A conservative estimate on the interest rate is between 3.1 - 5%, meaning the estimated interest on these bonds is $86,783,917. Interest is also subject to decrease with district financial stewardship and refinancing to pay them off sooner. We have been able to do this with existing bonds and reduce total interest payments.

How would I know the bond funds would be spent the way they are supposed to be spent?

Michigan law requires that the expenditure of bond proceeds be audited, and the proceeds cannot be used for repair or maintenance costs, teacher, administrator or employee salaries, or other operating expenses. An audit would be completed at the end of each series to ensure compliance.

What are “Indirect” or “Soft” Costs?

Indirect costs, sometimes referred to as “soft costs,” are costs required to prepare for and complete a construction project. They occur throughout the duration of the bond projects, which in St. Johns case are anticipated to occur over five to six years.

- Architect’s Fees (<8%): Fees to allow further program development, design, documentation of projects for construction, issuance of bidding documents and field observation during construction

- Construction Manager’s Fees (<8%): Fees to manage the construction process including:

- Ongoing estimating and budget confirmation throughout design

- Coordination of bidding process and post-bid evaluation of bids received

- Coordination of subcontractors

- On-site staffing for construction observation

- General Conditions (2%): Costs that support construction that are not captured by subcontractors’ bids. These include:

- Temporary facilities (Job trailer(s) and temporary restrooms, temporary fencing, on-site safety measures (signage, etc.))

- Temporary utilities (power, water, gas, etc.)

- Dumpsters for waste and recycling

- Material testing costs

- Permit fees

- Soft Costs/Consultants (2%):

- Geotechnical services

- Site surveys

- Permit fees

- Foodservice, technology and security consultants

- Commissioning services

- Contingency (10%)

- Reserved to accommodate unforeseen costs related to existing building and site conditions

- Reserved to accommodate unforeseen costs related to existing building and site conditions

How much money would the bond proposal generate, and would the funding be issued all at once?

The proposal would generate $92 million which would be spent over seven years. The bonds are proposed to be issued in three separate series (2024, 2026, 2028). This would allow for years of bond repayments to occur before a new bond issue is completed.

Would the approval of the bond proposal have any impact on our current operational budget?

While funding from this bond proposal is independent of the district's general fund operating budget, the bond would likely have a positive impact on the district’s general fund by allowing the district to reallocate operating funds that are currently being spent on aging facilities, mechanical systems, and technology. The operational savings generated from new and more cost-efficient facilities could be redirected to student programs and resources.

When would the millage for this proposal first be levied if the bond proposal is approved by voters?

On the December 1, 2024 property tax bill.

Are technology purchases going to be amortized (paid off?) over a 30-year period?

No. Most technology purchases are required to be amortized (paid off?) over a 5-year period beginning at the time of installation.

Are bus purchases going to be amortized (paid off?) over a 30-year period?

No. Bus purchases are required to be amortized (paid off?) over a 6-year period beginning at the time the buses are put into service.

Are businesses and second homes (non-homestead properties) and primary homes (homestead properties) treated the same regarding bond millage?

Yes, businesses and second homes (non-homestead properties) and primary homes (homestead properties) are treated the same regarding bond millage.

Are there property tax exemptions to anyone of any kind?

If a business has been granted an Industrial Facilities Tax ("IFT") credit then only half of the taxable value is subject to the bond millage. The business would need to verify if some of the taxable value has been designated for the IFT credit. One item a community member could research is the Michigan Homestead Property Tax Credit. The Michigan Homestead Property Tax Credit is a method through which some taxpayers can receive a credit for an amount of their property tax that exceeds a certain percentage of their household income. This program establishes categories under which homeowners or renters are eligible for a Homestead Property Tax Credit. We would recommend that community members consult their tax advisor to determine if they are eligible for this tax credit.

Can you help residents understand how schools of choice students impact the district?

The foundation allowance follows the student, which means the district receives State funding for each student that is enrolled at St. Johns Public Schools. For each student who attends through schools of choice, SJPS receives state funding, similar to how it receives State funding for in-district students.

Would money from the bond proposal be used to pay teachers’ salaries and benefits?

No. School districts are not allowed to use funds from a bond for operating expenses such as teacher, administrator or employee salaries, routine maintenance, or operating costs. Bond proceeds must be kept separate from operating funds and expenditures must be audited by an independent auditing firm.

What oversights would hold the district accountable?

If approved by voters, the district’s Architect/Engineer would design the proposed projects and prepare construction documents and specifications for the projects. Once the projects are designed, the district’s Construction Manager will assemble bid packages and publicly advertise to solicit competitive bids for all work. This is required by law, as outlined in the Revised School Code. This process ensures that the district selects the lowest responsive and responsible bidder. All qualified contractors will have an opportunity to attend a pre-bid meeting to obtain additional information and project clarification. All qualified contractors will have the opportunity to participate in the competitive bid process.

At what point would the State of Michigan, as well as the local fire and police departments, provide input regarding the bond projects?

Each project will be required to be submitted to both the Bureau of Construction Codes (BCC) and the Bureau of Fire Services (BFS) for both plan review and permitting. These agencies will review the projects to ensure they comply with applicable codes before any building permits are issued. Building plans and specifications must be signed and sealed by a Licensed Architect/Professional Engineer before submission. As of 2019, Michigan law requires school districts to consult on the plans for the construction or major renovation regarding school safety issues with the law enforcement agency that is the first responder for that school building. This consultation would happen after a bond proposal has been approved by voters and before construction documents are finalized prior to project commencement.

Voting Information Questions

How do I register to vote?

Visit Michigan.gov/vote to register to vote online. It is recommended by the Secretary of State to register by mail by April 22, 2024 to participate in the May 7, 2024 election. Individuals may also register in-person at their local clerk’s office through May 7, 2024, with the required documentation. For assistance in obtaining the address of your local clerk, visit Michigan.gov/vote.

Are owners of property in the school district eligible to vote if they do not reside in the school district?

Owners of property are only eligible to vote if they reside within the school district’s boundaries. To be eligible to register to vote you must be:

- A Michigan resident (at the time you register) and a resident of your city or township for at least 30 days (when you vote)

- A United States citizen

- At least 18 years of age (when you vote)

- Not currently serving a sentence in jail or prison

If I rent a house or apartment, can I vote?

Yes, if you rent a house or apartment, you can still vote. You must be a registered voter in the city or township you are living in and live within the school district’s boundaries.

How do I obtain an absentee ballot?

Registered voters must complete and submit the application to receive their absentee voter ballot. To vote by mail, fill out the application and sign it, and then return it to your local clerk. For assistance in obtaining the address of your local clerk, visit Michigan.gov/vote. When filling out the application, if you check the box to be added to the permanent absentee voter list, you will get an application mailed to you before every election.

If you registered to vote after absentee voter ballot applications were mailed, applications may be obtained online at Michigan.gov/vote. Absentee voter ballots are available as early as March 23 through election day, May 7, 2024.

Key dates leading up to the election:

Registering to vote:

- The last day for voters to register by mail is April 22, 2024

- Voters may register in person through May 7, 2024 (election day) with the required documentation

Absentee Voting:

- Absentee voter ballots are available as early as March 23 until May 7, 2024 (election day)

- On or before Saturday, March 23, 2024 - Absent voter ballots must be available to be sent to voters serving in the military or living overseas

- Absentee voter ballots must be available by Thursday, March 28, 2024 to be sent to members of the general public

- Contact your local clerk with questions

Attend a public information community forum:

- April 17 at 6:30 p.m. at the High School Media Center

Why construct a replacement transportation building?

Our existing maintenance and office structures are beyond their useful life expectancy. Constructing a replacement facility would not only update the building; it would also allow us to incorporate the transportation office into a new facility to eliminate an extra building and improve communication and staff efficiency.